Non-Adjustment of the Pensions According to Law 53-B/2006

Useful and intergenerationally fair

The social security and pension system is largely financed on a pay-as-you-go basis. Under this type of system, revenues collected from employers and employees are used to finance the pensions of current retirees. The system requires workers to give up a portion of their income in exchange for future generations contributing to their own pensions.

In September of 2022 the Portuguese government announced that in January of 2023 the pension adjustment formula, as described in Law 53-B/2006, would not be applied. According to the government, the application of the formula would mean that “the first negative balances of the welfare system would be anticipated to the late 2030s and [it was estimated] that the social security fund would be depleted by the first half of the 2040s.”1 In return, the government published a law that, among other measures, created an exceptional complement to retirees, corresponding to half of their October 2022 pension.2

Objectives:

Ensure social security’s sustainability. Increased equity in pension values across different generations.

Final assessment:

Useful and intergenerationally fair.

Affected Retirees

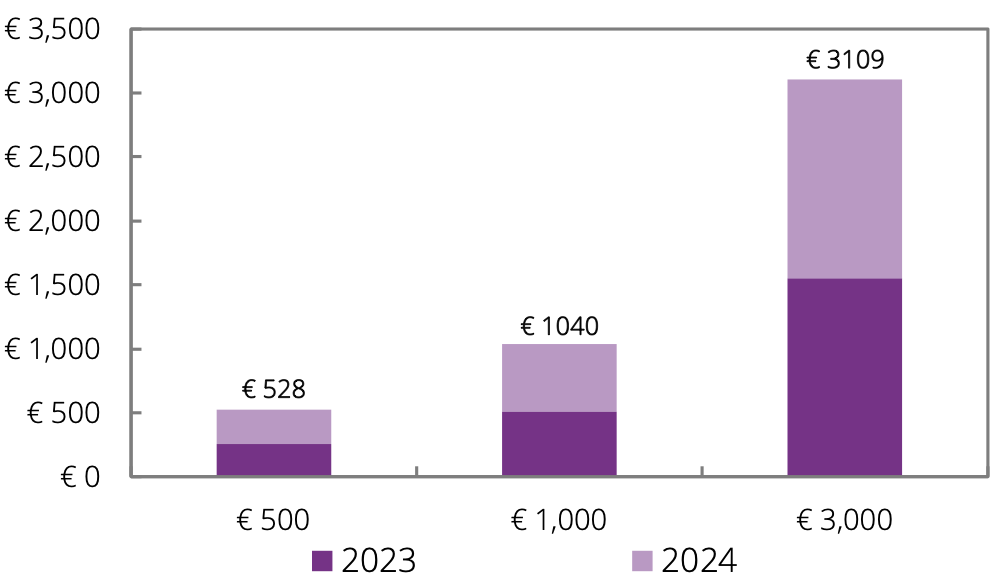

Figure 1 – Cumulative income loss in 2023-24 due to the non-enforcement of law 53-B/2006

Sources: Author’s calculations.

Pensions were increased by 3.9% to 4.8% in January 2023, depending on the original pension value. Had the formula described in law 53-B/2006 been applied, the increase would have been between 7.5% and 8.5%.

With the non-enforcement of the formula, to the detriment of the values established by law no. 19/2022, the retirees suffered a substantial cut on their pensions’ raises. Figure 1 shows the cumulative income loss for 2023 and 20243 due to the non-enforcement of the original formula in 2023. We present three different examples of pensions (500 euros, 1,000 euros and 3,000 euros). For all three cases, the combined loss would be greater than one month’s pension. The figures do not include the one-time complement to retirees created by decree-law no. 57-C/2022, which was equivalent to half the pension earned in October 2022.

Evaluation

Whereas today the population is concentrated in the 35 to 60 age bracket, towards the end of the century the population will be increasingly comprised of individuals in the 60 to 85 range.

Such a demographic shift raises the difficulty of guaranteeing intergenerational equity in a pay-as-you-go pension system. Increasing current pensions means transferring wealth from younger generations to older generations. This fact raises the question: is raising the pensions according to law 53-B/2006 intergenerationally fair?

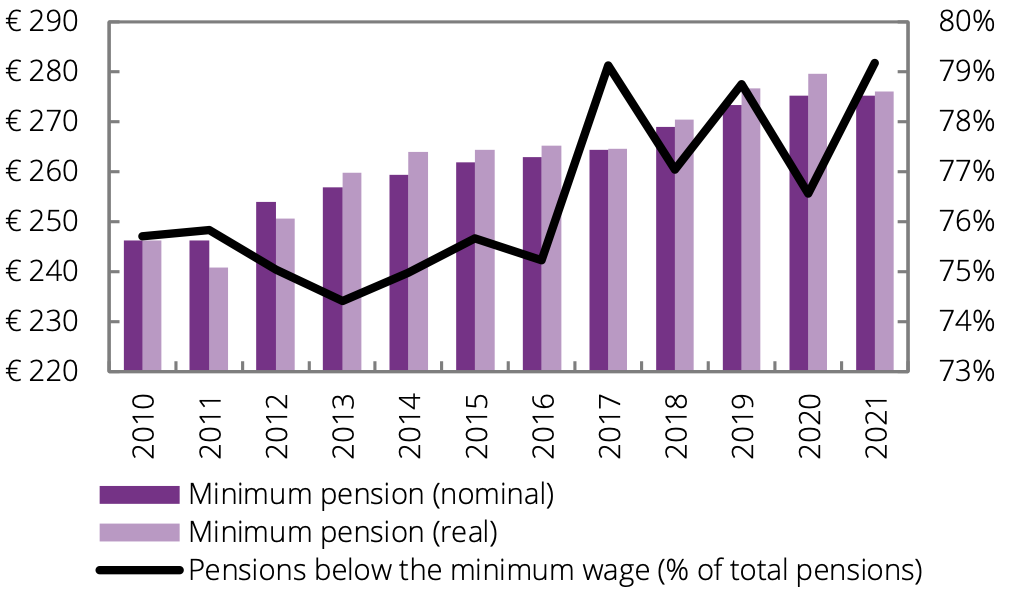

Figure 2 – Minimum pension amount in Portugal (2010-21)

Law 53-B/2006 was only applied correctly in one year (2016) since 2016. For all other years and for the lower pensions, there was a higher increase than foreseen by the formula. Figure 2 shows how the real value of the minimum pension has been systematically above the nominal value (taking 2010 as the base). This evolution contrasts with the more than 10% loss in purchasing power for civil servants between 2010 and 2021. Notwithstanding the large annual increases, the share of pensions below the minimum wage has been relatively constant at 75% to 80%.

Sources: Statistics Portugal, authors’ calculations.

We employ the generational accounting methodology that assesses the sustainability of public finances,

introduced by Auerbach et al. (1991, 1994). We assume that the functional distribution of public expenditure and tax revenues by age increase at the same rate, i.e., what determines the variations are the demographic projections that imply a difference in population size and age distribution.

The metric used to assess the impact on the sustainability of public finances was introduced by Franco et al. (2020) and considers an indicator, represented by ?, which indicates how much age-sensitive per capita revenues would have to increase to ensure that the intertemporal budget constraint (IBC) would be respected.

We tested the impact of increasing pensions by 5% permanently under 3 scenarios:

All other items grow at the baseline growth rate

+1.9%

Harms future generations

A 5% increase for all other items as well

-0.2%

Close to neutral

A 1% increase for VAT, social contributions and income tax

1.1%

Harms future generations

Intergenerational Fairness Evaluation of the Policy

- Does it move Portugal away from its vision of the future? No. The policy considers the pensions of future generations.

- Does it disadvantage any generation, current or future? No. The policy disadvantages current retirees, as the pension decreases in real terms. However, the current generation is at an advantage compared to future generations. The existing generation of retirees had to pay less into the system compared to future generations to get an equivalent pension. Our calculations show that increasing pensions by 5% hurts future generations.

- Does it disadvantage any specific age cohort in the population? No. Pension increases are larger for lower pensions, decreasing intragenerational inequality.

- Does it reinforce the transmission of inequalities across generations? No. The measure aims to transfer resources from present generations to future ones as a way to reduce the pension gap between the two generations.

- Does it limit the choices of future generations? No.

Final assessment:

Useful and intergenerationally fair.

Recommendations

The communication of social security reforms needs to improve.

Communicating the evidence-based gains for future generations of social security reforms helps to legitimize policies. Workers tend not to know their exact retirement age or the way the social security system works, and there is often uncertainty about the future value of their pension. Several studies show that informing citizens leads to increased support for these policies.

Informing about measures is important for workers. The provision of social security affects the labor supply of older workers and, consequently, decisions on consumption and savings.

1 Document “Avaliação do Impacto do Aumento das Pensões” delivered to the members of parliament.

2 For pensions up to €5318.4 per month (12 times the IAS).

3 Assuming that law 53 B/2006 would be complied with in 2024, an inflation rate of 4% and an economic growth rate of 1.8%.

Project Output files for download here.

Important Note: The word file must be opened before clicking for the first time in the excel.

About Authors